Why Is Coronavirus Fear Hitting the Banks?

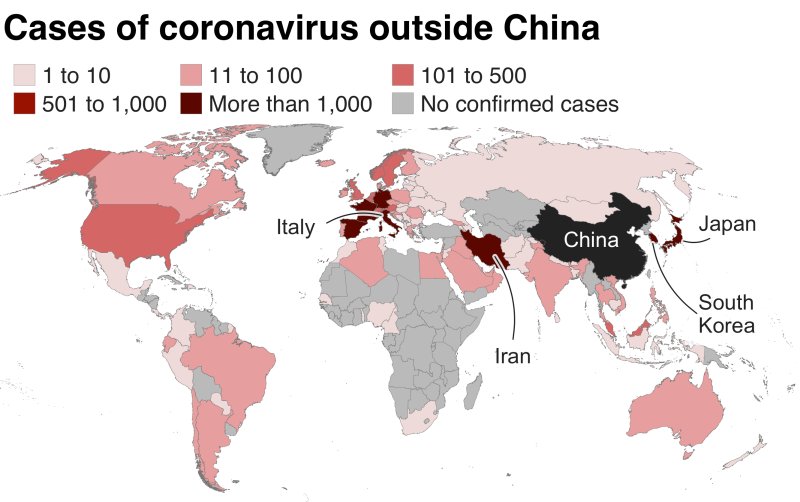

The COVID-19 epidemic has already influenced oil prices, stock indices, and world currencies. However, it has also affected the normal operation of banks, especially those that are situated or have their departments in Asia.

According to the Financial Times, some Western banks have even restricted the movement of their employees around Asia. It seems that coronavirus fear has hit not only the banking system but has provoked the beginning of the financial crisis.

As past crisis has shown, central banks around the world can quickly change their monetary policy in response to a sharp change in the economic situation, since they are mostly independent, operate within a clear mandate and rely on the theory and statistics.

The virus has already revealed four major problems for national economies:

- Losses from rising risks that do not include actual losses.

- Actual losses from a decrease in the country’s external operations.

- Losses from the introduction of quarantines.

- Chain reaction stimulated by the fall in business and consumer activity.

Fears and Predictions

According to Moody’s Analytics, the COVID-19 could affect the global economy more than the financial crisis of 2008-2009. Unlike the collapse in the US mortgage market, no one predicted the emergence of the pandemic in 2020. Politicians may thus be limited in their ability to eliminate the malicious impact on stocks and national economies caused by the virus.

The spread of the Chinese virus will cost the global economy more than $280 billion in the first quarter of 2020. It will put an end to the continuous growth of the world GDP, which lasted 43 consecutive quarters.

If the virus does not spread around the world and China starts production soon, the global economy will lose only 0.1% of the predicted growth for 2020. This is a good scenario for the global market and trading online.

Limitation of Movement

The International Monetary Fund and the World Bank announced that they will hold an annual spring meeting, scheduled for April 13-19, in a “virtual format” due to the COVID-19 epidemic.

Credit Suisse management recommends employees in Hong Kong work from home and avoid visiting a bank office if they frequented the mainland for the past 14 days. Employees who have flu symptoms should stay at home for two weeks and return to work only with a doctor’s permission.

UBS also advises their employees to stay home if they have recently visited China. The UBS offices in China continue to operate normally, but other employees are prohibited from travelling to China.

The Standard Chartered financial group has limited travelling to China and Hong Kong. To stop spreading the virus, some branches are even cutting working day hours.

It’s not only banks that have been hit by the epidemic: the absence of decisive measures to support the economy from the Trump administration has led to a sharp quotation decline in the NY exchange. Forex trading in general also slows down.

How Banks Will Help the Economies to Recover?

The World Bank will allocate $12 billion to help states cope with the spread of the COVID-19 and overcome the negative economic consequences of the epidemic. Even though most WB programs are loans, the poorest countries will receive part of the funds in the form of grants.

As for national and local banks, they expressed their readiness to support people and business hit by the COVID-19. People facing financial difficulties are offered mortgage or credit holidays for up to 3 months.

Additionally, some financial institutions reduce their interest rates or increase the credit limits for their clients. These measures are taken to support the most vulnerable parts of the population, especially those who faced salary suspensions or working hours cuts. The repayment holidays are also offered to business that takes loans for $25,000 and more.

Every crisis is a new beginning for the world of finance. Every broker will confirm that the economic decline is always replaced by growth. So, why not take advantage of it?